Switch to:

EN

EN  Português (PT)

Português (PT)  Español (ES)

Español (ES)

With a fleet of 1,978 private jets, Brazil is widely considered the world’s second largest business aviation market. But are there really any meaningful opportunities for the innovation within the sector?

Is this the Right Time for Private Aviation in Brazil?

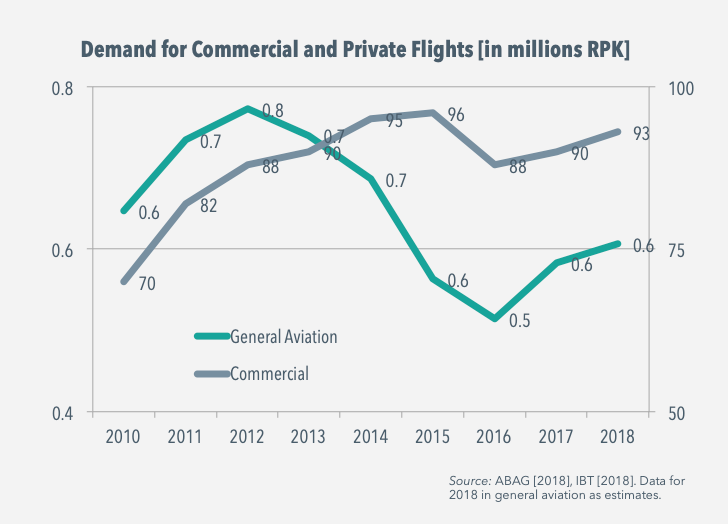

In 2017, the general aviation sector registered more than 583,000 general aviation operations, a 13% spike on a year-on-year basis. After a lingering political malaise of 2013-2016, such results can be seen as promising, although the flight activity still remains below the all-times high of almost 0.8 mm flights realized back in 2012. It’s worth highlighting that February 2019 was the 23rd month of consecutive growth for commercial flights.

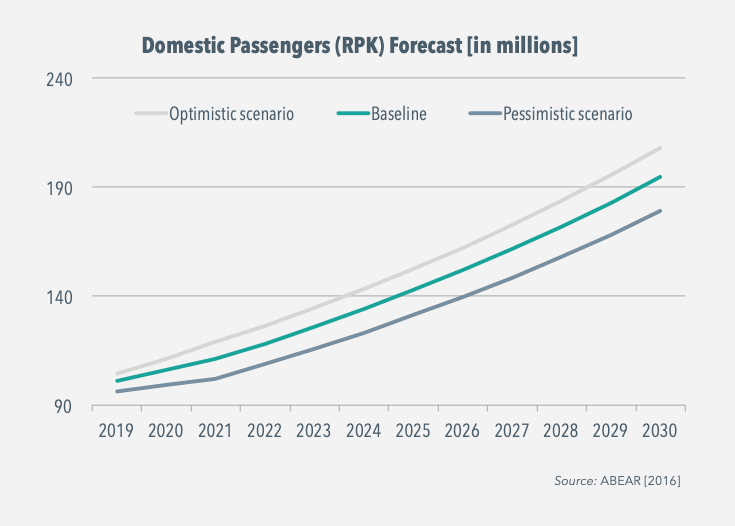

According to ABEAR, there are high prospects for growth of commercial flights in Brazil in the coming years. Even considering the pessimistic scenario, the sector is projected to grow steadily until 2021, after which it is likely to accelerate and expand at the rate of 6-8% YoY.

Regional Focus

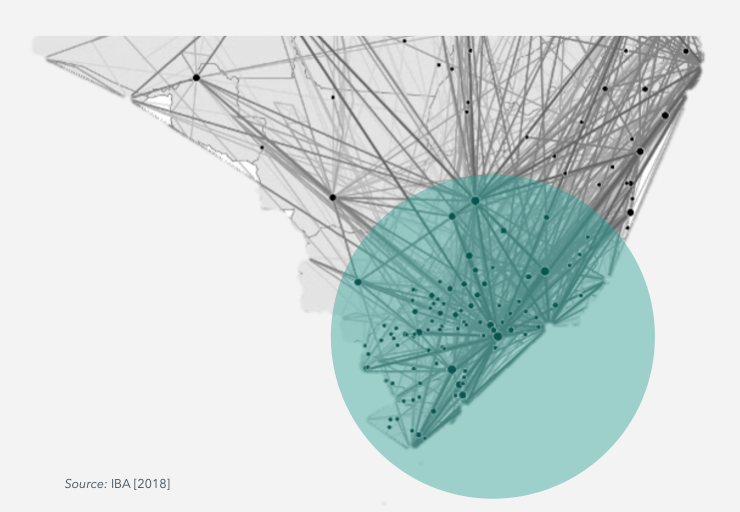

Interestingly enough, as much as 88% of all flights in general aviation segment in Brazil take place within the radius of 1,000 km (621 miles) from São Paulo. Such operations can be realized in up to 2 hours in turbo-props and small jets, making it a perfect ecosystem for executive aviation. Out of the existing 2,450 airports, only 101 currently receive a scheduled service. Premium destinations with smaller airports is where the opportunities really lie within the Brazilian private aviation sector. Worth noting that only 1% of all flights are international. Continental in size, Brazil favors a “local-first” approach.

The São Paulo – Rio de Janeiro connection, previously the world’s busiest passenger air route, is responsible for a large chunk of executive flights, too. Outside of the key commercial hubs, the main destinations for private aviation include the coastal cities of Angra dos Reis, Paraty, and Ilhabela. São Paulo itself has the world’s largest helicopter fleet and there are three Brazilian cities in top 10 of the list. Currently, there are 500+ helicopters in São Paulo and more than 40 helipads are used on a daily basis (with 200+ helipads officially registered in the city). Here is an interesting fact: there is no domestic first class in Brazilian commercial aviation!

Demand per City – General Aviation in Brazil

| City Airport Cluster | Avg. Distance from São Paulo | General Aviation Flights Q1 ’18 | Share |

| São Paulo (GRU,CGH,SBMT) | – | 35,850 | 24% |

| Rio de Janeiro (GIG,SDU,SBJR) | 366 km | 28,752 | 19% |

| Belo Horizonte (CNF,PLU) | 504 km | 8,561 | 6% |

| Goiânia (GYN) | 823 km | 8,971 | 6% |

| Navegantes (NVT) | 414 km | 5,528 | 4% |

| Salvador (SSA) | 1,480 km | 5,311 | 4% |

| São José dos Campos (SJK) | 92 km | 5,200 | 4% |

| Vitória (VIX) | 756 km | 5,067 | 3% |

| Londrina (LDB) | 458 km | 4,830 | 3% |

| Florianópolis (FLN) | 487 km | 4,153 | 3% |

| Uberlândia (UDI) | 551 km | 4,022 | 3% |

| Brasília (BSB) | 872 km | 3,957 | 3% |

| Porto Alegre (POA) | 838 km | 3,625 | 2% |

| Ribeirão Preto (RAO) | 300 km | 3,424 | 2% |

| Manaus (MAO) | 2,704 km | 2,783 | 2% |

| Fortaleza (FOR) | 2,373 km | 2,596 | 2% |

| Recife (REC) | 2,129 km | 2,518 | 2% |

| Belem (BEL) | 2,475 km | 2,003 | 1% |

| Others | – | 10,582 | 7% |

Customers & Profitability

Brazil is widely known as the only country in Latin America with a thriving Upper-Middle Class. Flapper’s own analysis conducted on the basis of the data collected from Serasa and the ANAC (National Civil Aviation Agency of Brazil) points to a market potential of up to 2.0 million pay-per-seat clients. There are more than 70 million online users in Brazil aged 25-60, including 380,000 of those earning R$20,000+ / month.

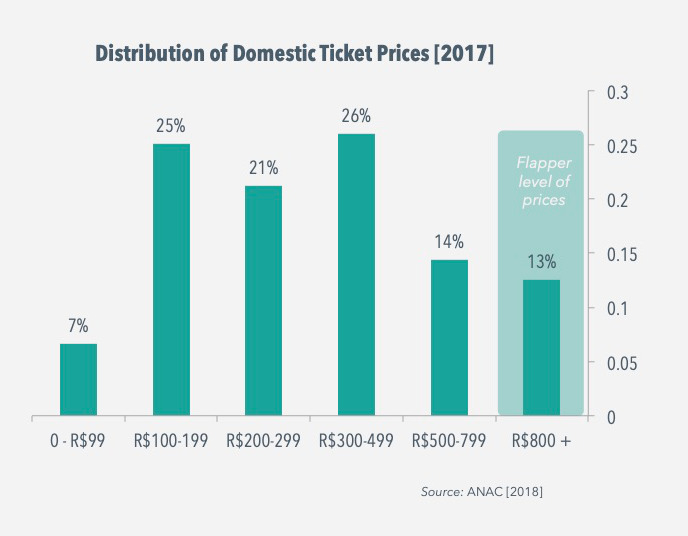

Domestic flights are generally priced at R$300 or less (around US$100). The top 13% cost around the same as Flapper shared flights.

The majority of the commercial flights have a tiny yield of up to R$0,49 per km. However, more than 2.5% of the flights yield R$1.5 per km or more.

Considering that (i) 2.5% of the total of 93 million seats in domestic flights are sold with a yield value equal to or higher than R$1.50, and that (ii) that the average yield to be considered for the purposes of this analysis is equal to R$1.50, and that (iii) the average distance of domestic flights is 1,105 km, the total addressable market is R$3.9 billion (US$1 billion).

It’s worth highlighting that online travel sales in Brazil have grown by 8-10% per year and are projected to reach U$ 9B in 2019.

Conclusion

The Brazilian market represents a unique opportunity for further expansion of new commercial models in private aviation. A combination of unique structural factors and the timing turn it into an ideal ecosystem for the growth of shared flights and on-demand charters alike.

Improved access to technology and inclusion of shared flights can boost the size of the sector by the factor of 2x and actively contribute to the development of regional aviation.