Switch to:

EN

EN  Português (PT)

Português (PT)  Español (ES)

Español (ES)

As the pandemic recedes, business aviation companies are left wondering what they’ve been through and what the future holds for the sector. With no doubt, the Covid-19 outbreak accelerated the development of a number of technologies vital for general aviation, while it also left a mark on consumer behavior. With the demand for private flights in Q3 2021 some 10-25% above the pre-pandemic levels, the key stakeholders look for the means to optimize their supply types and invest in the most promising frontier technologies. Check out in this article, the main trends in business aviation for the coming years.

The Flapper charter team has recently participated at ACE 2021, organized annually at London Biggin Hill Airport. This leading air charter-focused event constitutes a great opportunity to study the evolution of business aviation and to have a firsthand view of the emerging technologies poised to drive the industry’s growth in the coming decades.

We’ve listed the top three business aviation trends that will likely shape your future. The list is not exhaustive, but it highlights some of the most promising trends in business aviation and general aviation that are on the rise in the sectors.

Electric Aviation has Arrived and is Here to Stay

One of the trends in executive aviation that gained prominence during ACE 2021 was Cassio 1, a fully electric light airplane built by France-based VoltAereo. This demonstrator aircraft, which was exhibited at the event’s main hall, has flown more than 4,900 km (3,050 miles) across the English Channel to make it to the event. Just six years ago, VoltAero’s other electric airplane E-Fan crossed the Channel for the first time.

E-Fan’s 60 kilowatt of battery power looks rather bleak comparing to Cassio’s 600-kilowatt electric-hybrid module. As batteries and avionics improve, larger and larger aircraft will soon fly green, permanently changing the landscape of business and commercial aviation alike.

Another promising piston aircraft heavily discussed during the show was Tecnam’s P-Volt. The Italy-based manufacturer aims to begin deliveries of the nine-seat commuter airplane already in 2024. The recently launched sister aircraft P2012 Traveller – exhibited during the show – will be used as the test ground for future transition to an all-electric module.

At least ten other highly-viable electrically powered airplane projects are under development, including the likes of Ampaire, MagniX, Eviation, Rolls Royce or Embraer. The main question oscillates around the choice between a clean sheet design (e.g. Eviation) and adaptations to existing models (eCTOL – electric conventional takeoff and landing, see: Magnix / Ampaire). Nearly all main OEMs, from Boeing to Airbus to Daher, currently engage in similar initiatives.

eVTOL and eSTOL Everywhere

Advanced Air Mobility (AAM), which encompasses air transportation using electric and hydrogen-powered takeoff and landing vehicle, was a major consideration this year. It is projected to impact not just traditional aviation sectors, but especially the car industry, with a significant share of the current luxury car owners poised to migrate to urban air mobility (also referred to as UAM).

By some estimates, the market for AAM will reach US$32 billion by 2035. A recent UAM white paper by Roland Berger predicts there will be more than 160,000 vertical mobility aircraft by 2050. In line with the forecasts issued by analysts, I expect the AAM to be the single most impactful advancement over the current aircraft propulsion technology.

The following eVTOL (electrical takeoff and landing) and eSTOL (electric short takeoff and landing) companies were either present or widely discussed during the Air Charter Expo 2021:

- Archer. Equipped in 74 kilowatt of batteries, this twelve-rotor eVTOL can travel distances of up to 96 km (60 miles) at speeds of up to 241 km/h (150 miles/h). One of the few publicly listed players in the AAM field, Archer has joined the NYSE on September 20th, 2021. It recently struck the deal with United Airlines for the purchase of up to 300 units of its passenger drone.

- Joby Aviation. Joby’s full size (passenger capable) aircraft tests begun already in 2019. The six-rotor engine of Joby S4 can take it to speeds of 322 km/h (200 mph). Its powered by lithium-nickel-cobalt-manganese-oxide batteries, providing a range of 241 km (150 miles). Joby has recently signed a partnership with NASA focused on conducting noise tests using an array of 50 ground microphones provided by NASA’s engineering department. It listed on NYSE in August 2021.

- Vertical Aerospace. One of the would-be panelists during the event, Lawrence Blakeley, believes in the iterative approach to aircraft design and development. Vertical currently deploys two test aircraft: VA-X4, a 5-seater, equipped with 4 propellers mounted on wings and a v-tail configuration; and Seraph, a piloted air taxi aircraft capable of carrying 250kg.

AAM Race to the Future

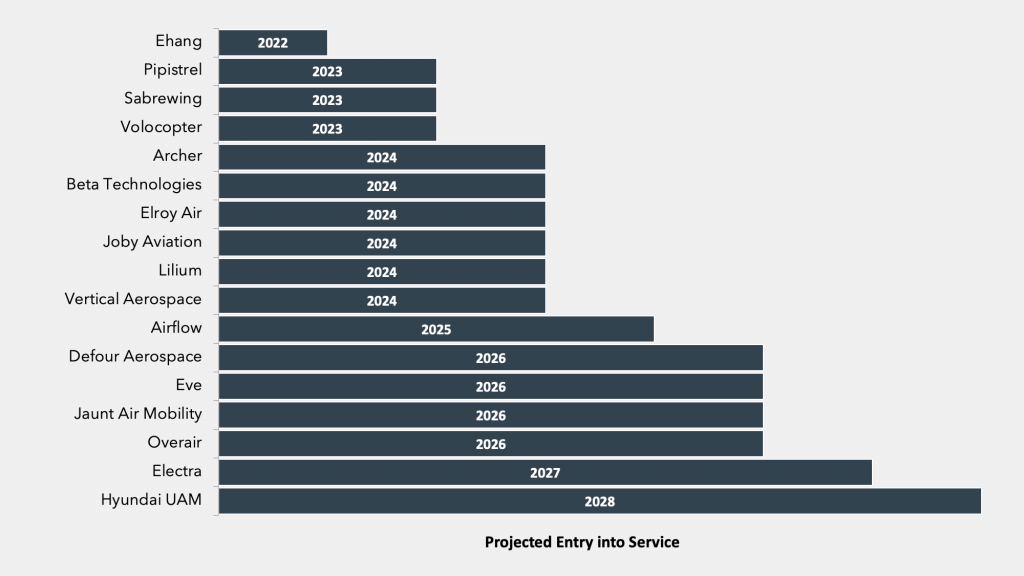

The majority of the next-generation vertical mobility companies estimate their entry into service (EIS) to commence in the second half of the current decade, highlights a recent research produced by SMG Consulting. Some, including Ehang, Volocopter, Airbus and Joby, have already conducted their first official flight tests while overlooked by the local aviation authorities.

Sustainable Aviation Fuels

On September 20th, 2021, Shell announced an ambitious plan to reach an equivalent of 2 million tonnes of sustainable aviation fuel (SAF) production capacity by 2025, a ten-fold increase from today’s total global output. Just a week earlier, NetJets Europe became the first operator to purchase Air BP’s SAF from its refinery in Spain. The company aims to supply up to 1.23 million liters (325,000 USG) to its customers during the first 12 months only.

Business aviation’s global CO2 emissions are approximately 2% of all aviation, itself responsible for roughly 2% of all global emissions and 12% of all emissions from the transport sector. Although small in overall size, it is considered one of the toughest sectors to tackle, as increased power led to the development to enriched (and highly polluting) jet fuel, used until today.

Traditionally sensitive to margins, aviation sector is also the most vulnerable from the point of view of the cost structure. Currently comprising just 0.01% of aviation fuel, SAF costs two to four times as much as kerosene.

One of the key initiates aiming at embracing the environment challenge is the Green Charter. Part of the Air Charter Expo, it aims to raise the awareness of the importance of SAF and provide a platform for the high-level discussions on the topic.

One of the members of the Green Charter is 4Air, a framework designed to highlight those committed to addressing the impact of the CO2 emissions. The most recent initiative of the company includes na interactive map of SAF locations. Some 20 verified fuel stations with sustainable fuel were mapped to help private jet owners navigate in the sea of fixed base operators and airports.

According to Safran, the world’s leading helicopter engine OEM, a 100% incorporation of SAF reduces CO2 emissions by up to 80%. Currently, its engines are certified to operate with up to 50% SAF.

Number one reason why sustainable aviation fuels constitute a disruptive force is its potential impact on attracting new entrants to the business aviation world. The so-called “flight shaming” could permanently threaten business aviation’s position as the strategic provider of transportation to businesses, governments and medical entities. In fact, some 40% of millennials believe that climate change will have the biggest impact on the development of sustainable personal air transport – higher than AI and digitization, as per EBACE 2019 study.

Business Aviation Trends: Final Thoughts

Perhaps the main question related to trends such as AAM, electric aviation or SAF is the actual eagerness of the general aviation community to be embrace the change. A private jet customer has traditionally valued agility over costs and pragmatism over avant-garde. Are they ready for a technological rebound?

Especially when it comes to electrifying aviation, our sector faces a once-in-a-kind opportunity, serving as an efficient test ground for hybrid-electric and fully-electric airplane development. As the technology becomes safer and more reliable, we will see it transition from light-to-heavy aircraft, eventually disrupting even the longest trans-continental flights.

The SAF adoption should be pushed by the governments, engine manufacturers and the OEMs themselves. The UKs’s Jet Zero Council, a partnership of airlines, airports, R&D entities, fuel manufacturers and the ministries provides a benchmark for such collaboration. We need the legal frameworks now, as the transition will take years, if not decades.